Букмекерская контора Бинго Бум

В 2017 году список лицензионных букмекерских контор пополнил такой известный на территории России оператор, как Бинго Бум, впервые заявивший о себе в 2011 году. Несмотря на молодой возраст, на сегодняшний день насчитывается более 700 пунктов приема ставок во многих городах страны. Деятельность российского букмекера основана на лицензии №22, полученной от ФНС РФ 14 марта 2012 года. Рассматриваемый оператор также является членом саморегулируемой организации (СРО) «Ассоциация букмекерских контор». На основе всего этого с 2017 года на официальном сайте конторы bingoboom.ru появился новый раздел под названием «Спорт», где каждый желающий может делать спортивные ставки через ЦУПИС «КИВИ Банка».

Обзор официального сайта

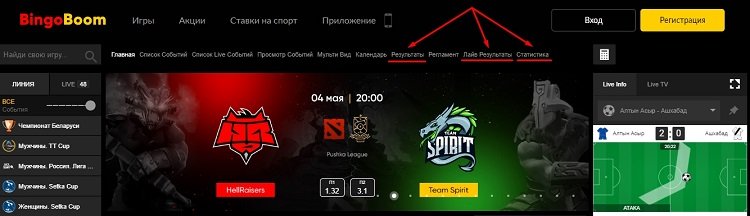

Зайдя на сайт Bingo Boom, следует выбрать категорию «Спорт» и откроется следующая страница.

Навигация по самому сайту не вызывает трудностей, все достаточно легко и удобно.

Порядок проведения расчетов

Пополнить счет можно при помощи:

- карт VISA и Мастеркард;

- кошелька QIWI;

- мобильных операторов;

- салонов «Евросеть».

Вывести средства можно только 2 способами:

- через банковские карты (время вывода до 5 рабочих дней);

- QIWI-кошелек.

При выводе финансов с чистой прибыли будет вычтен налог в 13%.

Важно знать:

Если сумма проставленных средств значительно меньше депозита, то букмекер оставляет за собой право ввести комиссию в 10% от выводимой суммы.

Регистрация

Все происходит в 3 этапа.

- Регистрация на самом ресурсе букмекера.

- Регистрация QIWI-кошелька с максимальным статусом идентификации

- Пройти идентификацию можно в ближайшем ППС российского оператора, салоне «Евросеть» или самого QIWI. Во всех случаях придется показать паспорт и заполнить анкетные данные. После этого на указанный при регистрации номер будет выслан код, его надо будет указать в личном кабинете QIWI-кошелька.

После прохождения этих этапов можно спокойно делать ставки.

Условия игры

Сразу на 22 спортивных направления можно сделать ставки в БК Бинго Бум. Число видов спорта будет постоянно увеличиваться, о чем даже упомянуто в самих правилах. На самом ресурсе отображаются только те спортивные категории, на которые выставлена линия, если событий, например, на керлинг в ближайшее время не предусмотрено, то название этого вида спорта в общем списке даже не будет отображено.

Характеристика линии

Это касается всех видов спорта. Такой принцип отображения спортивных событий подойдет не для всех бетторов, многие начинают изучать линию задолго до начала противостояния, следя за движением коэффициентов и на основе этого заключая пари.

Роспись противостояний

Мы видим, что даже международная встреча расписана при помощи исходов, фор и тоталов. Теннисные поединки представлены не самым лучшим образом, встречи в рамках турниров ITF-категорий расписаны 1-3 видами пари. Какую-либо экзотику здесь увидеть сложно.

Уровень коэффициентов

На примере футбольного матча «Ахмат-Зенит» сами рассчитаем закладываемую оператором маржу.

Берем два противоположных исхода: не проигрыш хозяев (1Х) с коэффициентом 1.97 и победу гостей (П2) за 1.90. Теперь высчитываем маржу:

(1/1.97) + (1/1.90) = 50.76 + 52.63 = 103.39 (маржа 3.39% — очень хороший показатель).

В среднем букмекер закладывает маржу в 6%.

Ставки live

В любое время российский оператор предлагает к вниманию своих пользователей хорошее предложение событий по многим видам спорта, со средней росписью. Отсутствует возможность просматривать наиболее популярные из них при помощи функции «видеотрансляция». Текущие статистические данные можно отслеживать посредством неплохого графического матчтрекера, где отображается не только подробная статистика, но и отмечаются наиболее опасные моменты матча.

Служба поддержки

В любое время суток при наступлении затруднений различного характера следует обратиться за помощью к специалистам службы поддержки. Задать вопрос можно:

-

по живому чату; форме обратной связи; позвонив на номер 8 (800) 301 43 43 (звонок бесплатный).

Все спорные вопросы касательно неверно рассчитанных ставок разрешаются в письменном порядке. Букмекер оставляет за собой право рассматривать такие письменные обращения в течение 30 дней.

Бонусы от БК Бинго Бум

Наблюдается только одно предложение: при регистрации и прохождении идентификации на игровой счет пользователя будет переведено 500 бонусных рублей.

Некоторые бетторы в различных источниках вычитали об еще одном более привлекательном бонусе: 50 тыс. RUB при регистрации, но это не относится к спортивному беттингу.

Отзывы о Бинго Бум

Данный обзор пишется через несколько месяцев после запуска нового раздела под названием «Спорт», поэтому к данному направлению в первое время стоит относиться более благосклонно, понятно, что он еще пока сыроват. Сам букмекер также понимает свои недочеты: отсутствие мобильной версии, не самая широкая бонусная программа, нет возможности просматривать некоторые встречи в режиме онлайн и т.д. Но по исправлению всех этих недостатков ведется реальная активная работа.

Хоть прошло немного времени, но в мировой паутине уже есть небольшое число мнений, в них отмечается, что пользователи ожидают таких же приемлемых условий игры, как и в действующих пунктах приема ставок, не ожидают от конторы каких-либо мошеннических действий, чего не было в ППС.

В целом российские бетторы активно регистрируются на представленной игровой площадке, даже имеющиеся условия позволяют заключать пари во вполне комфортных условиях, особенно это касается ребят, любящих делать ставки на футбол.

Ставки на спорт на Sport- Boom — это качественная спортивная линия, быстрые выплаты, достойные коэффициенты и круглосуточная поддержка. Здесь можно делать ставки на спорт и киберспорт в режимах лайв и прематч, играть в предложенные на сайте игры, чтобы досуг стал разнообразнее. Для большей выгоды клиентам предлагают принять участие в акциях и воспользоваться бонусами в рамках действующих программ. На первый взгляд нельзя точно сказать, насколько безопасным является сотрудничество с букмекерской конторой. Чтобы сделать окончательный вывод, БК нужно рассмотреть внимательнее. Также важно остановиться на отзывах игроков, которые имели опыт работы с конкретным букмекером.

Каждый игрок может официально решить любые вопросы. Именно эта контора отвечает за работу сайта, принимающего ставки. Дополнительно для связи с представителями БК игрокам предлагают воспользоваться онлайн-чатом.

Вместе с bingo boom букмекерская контора отзывы ищут:

- bingo boom вывод денег

- бк бинго бум приложение

- bingo boom промокод для новых

- бездепозитный бонус бинго бум

- bingo boom википедия

- bingo boom работа