Букмекерская контора Bingo Boom

Характиристики

Букмекерская контора BingoBoom надежно закрепилась на рынке спортивного беттинга России, хотя изначально ее воспринимали как слоты и онлайн-казино. Бинго-Бум является партнером футбольных клубов «Оренбург», «Рубин» и «Арсенал Тула».

Официальный сайт BingoBoom

Регистрация на сайте BingoBoom без идентификации дает доступ к демо-линии, где можно просмотреть котировки, но не сделать ставки. Полная версия сайта, кроме спортивных ставок, предлагает лотереи и мини-игры. Кроме линии, доступны разделы «Лайв» и «Результаты», а также каналы связи со службой поддержки: лайв-чат и форма обращения к оператору.

Разработано приложение Бинго Бум для iOS и Андроид и мобильная версия сайта. Меню минималистично: «Игры» (небукмекерские азартные игры), Live, «Линия» и «Результаты». Ввод и вывод средств, чат со службой поддержки, как и регистрация, на мобильном сайте доступны.

Регистрация в ЦУПИС

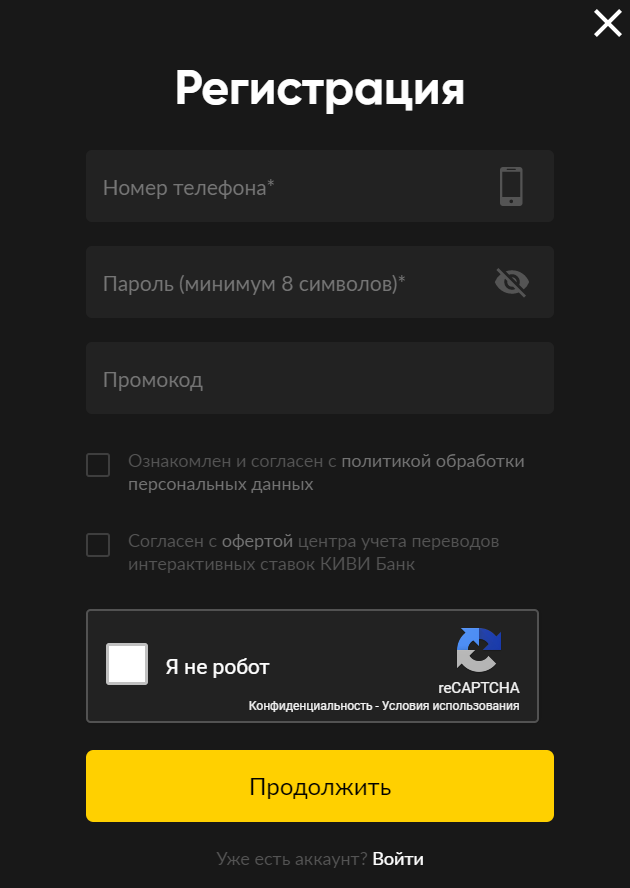

Регистрация в BingoBoom стандартна: для входа в личный кабинет на сайте, нужно ввести в регистрационной форме номер телефона, адрес электронной почты, задать пароль. Там же указывается промокод, чтобы получить бонус при регистрации. Букмекер водит в ЦУПИС при СРО «Ассоциация букмекерских контор» и для игры в этой легальной БК необходима идентификация в этой организации.

Зарегистрироваться в ЦУПИС нужно тем, кто ранее этого не делал в СРО. Остальным достаточно привязать аккаунт к учетной записи ЦУПИС. Идентификация в Бинго Бум проводится через систему Qiwi. Если у беттора уже создан кошелек Киви с полной верификацией, нужно просто указать при регистрации номер телефона, на который оформлен аккаунт в Киви.

Зеркало букмекеру — больше не нужно, он работает абсолютно легально, и Роскомнадзор его не блокирует.

Пополнение счета

Варианты пополнения счета:

- Банковские карты: Сбербанк, Альфа-банк, Тинькофф Банк и другие.

- Электронные кошельки: QIWI и Яндекс.Деньги.

- Мобильные операторы: «Мегафон», «Билайн», «Ростелеком», МТС и «Теле2».