Регистрация в БК Bingoboom

Бинго Бум регистрация

Как зарегистрироваться на сайте Бинго Бум

Наверное, каждый из нас не рад узнать о том, что вместо веселого времяпрепровождения ему предстоит какая-нибудь нудная процедура вроде оформления документов, отправки запросов и всего того, что связано с бумажной волокитой и заполнением миллиона анкет. Похожие эмоции испытывает игрок, который понимает, что вместо того, чтобы делать ставки, ему предстоит сначала зарегистрироваться. Но процедура создания аккаунта на сайте некоторых букмекеров может быть легкой и быстрой. О том, как проходит Бинго Бум регистрация, читайте в нашей статье.

Бинго Бум регистрация: 4 шага на пути к ставкам на спорт

Некоторые сервисы сайта этого популярного букмекера доступны и для неавторизованных пользователей, но, увы, чтобы играть на деньги и зарабатывать на ставках, нужно зарегистрироваться. У процедуры, которую предлагает Bingo Boom, есть несколько особенностей, все они связаны с тем, что работает эта БК на российском рынке легально. Но обо всем по порядку. Итак, чтобы создать аккаунт, нужно предпринять несколько шагов:

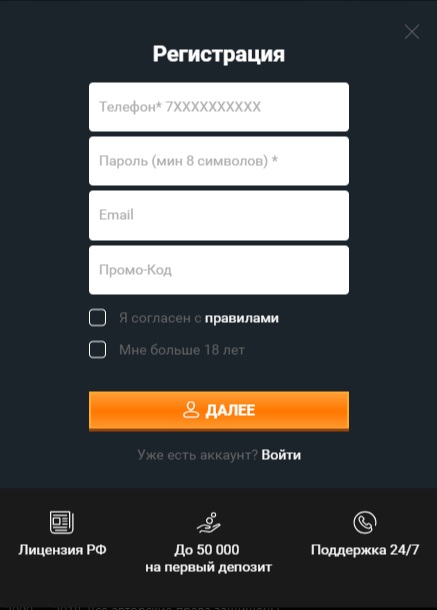

- Для начала найдите регистрационную анкету. Для этого перейдите на сайт Бинго Бум (прямую ссылку вы можете найти вверху этой страницы) и кликните «Регистрация».

- Заполните все нужные поля. На этом этапе понадобится добавить номер мобильного и придумать пароль. Еще один важный момент – обязательно используйте промокод Bingo BoomSLD1322187, чтобы букмекер начислил вам бонус на первое пополнение депозита (максимум – 100 000 рублей). Не забудьте кликнуть согласие с правилами БК и пройти проверку капчей. Не самые интересные, но нужные процедуры.

- После этого вам нужно будет дождаться смс с кодом. Введите его для подтверждения номера. К сожалению, на этом Бинго Бум регистрация не заканчивается, предстоит пройти еще одну процедуру.

- Идентифицируйтесь. Этот шаг – обязательный для каждого беттера, который хочет делать ставки с российским букмекером, а вот способы для этого предлагаются самые разные. Чтобы пройти идентификацию в системе Бинго Бум, нужно прийти в ППС с телефоном и паспортом. Там кассир быстро и бесплатно оформит все документы, и сразу после этого вы сможете играть. Все нужные данные нужно будет также указать в личном кабинете.

Готово! На этом этапе «тяжеля и нудная» Бинго Бум регистрация завершена. Остается только пополнить счет и начать играть.

Напомним, по нашему уникальному Bingo Boom промокоду SLD1322187 вы можете получить 100 000 рублей за создание аккаунта.

Возможности незарегистрированных игроков

Какой бы простой ни была процедура создания личного кабинета, иногда не хочется даже нажимать лишнюю кнопку. Конечно, на ставках без регистрации не поиграешь и большой куш не сорвешь, но кое-что можно сделать и просто зайдя на сайт:

- Изучить предложение букмекера. Посмотреть, какие есть события в линии и лайве, познакомиться с бонусными программами и промоакциями, скачать приложение и изучить его – для всего этого регистрация Бинго Бум не нужна.

- Поиграть. На сайте этого букмекера есть несколько вариантов игр. Вы можете сыграть в них совершенно бесплатно, выбрав в меню «Демо-режим».

- Посчитать возможный выигрыш. Вы можете добавить интересные события в купон, выбрать тип пари, ввести сумму и посмотреть, сколько сможете выиграть.

- Узнать информацию о компании и обратиться в службу поддержки. Все документы, по которым работает Bingo Boom, выложены на сайте, там же вы можете найти правила приема ставок, а еще – написать в службу поддержки и уточнить все непонятные моменты. Бинго Бум регистрация для этого не требуется.

- Изучить статистику. Для тех дисциплин, ставки на которые предлагает букмекер, на сайте можно найти результаты последних матчей и даже статистику команд.

Процесс регистрации в Бинго Бум не сложен, но требует от игрока немного времени, чтобы прийти в пункт приема ставок лично.

Смотрите с bingo boom играть ищут:

- бинго бум играть онлайн демо

- bingo boom вакансии

- bingo boom 37 online играть

- скачать букмекерская контора bingo boom

- бингобум ру играть

- бинго бум промокод на 1000 2020

- bingo boom вход